Dublin, June 20, 2024 (GLOBE NEWSWIRE) -- The "U.S. Construction Equipment Market - Strategic Assessment & Forecast 2024-2029" report has been added to ResearchAndMarkets.com's offering.

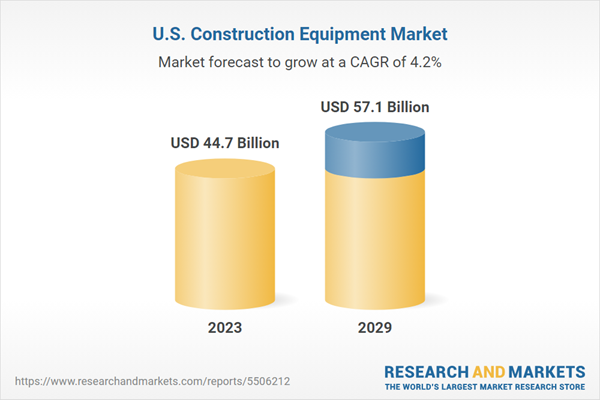

The U.S. Construction Equipment Market was valued at USD 44.70 billion in 2023, and is expected to reach USD 57.10 billion by 2029, rising at a CAGR of 4.16%

Caterpillar, Komatsu, John Deere, XCMG, Volvo CE, Liebherr, SANY, and Hitachi Construction Machinery are market leaders in the U.S. construction equipment market. These companies have strong market share and offer diverse equipment.

Earthmoving equipment accounted for the largest market share in the U.S. construction equipment market in 2023. Excavators in the earthmoving segment accounted for the largest share in 2023. Rising investment in housing, port expansion, and public infrastructure projects is expected to drive the demand for excavators in the U.S. construction equipment market.

In Dec 2023, Kobelco Construction Machinery Co., Ltd. announced the launch of its new G-4 series hydraulic crawler cranes with three new crawler cranes: CKE900G-4 with 100 metric tonnes x 3.6m max. lifting capacity; CKE1350G-4 with 150 metric tonnes x 4.4m max. lifting capacity and CKE2500G-4 with 250 metric tonnes x 4.6m max. lifting capacity.

The Terex CTT 292-12 flat-top tower crane stands out with its robust features, including a 12-metric-ton maximum capacity and a 70-meter jib length. The Power Plus feature provides a 10 percent boost when required. The Terex CTT 292-12 prioritizes operator comfort and precision with fully customizable settings and advanced electronics. It is equipped with the Terex T-Link telematics platform, providing remote access to crane fleet data. The crane also features Terex T-Torque, utilizing inverter technology with torque control on slewing motors for enhanced operator control over crane movements.

The Jaso J390 low-top crane is a revolutionary heavy lift solution known for its modular design. Its aim is to seamlessly integrate power, efficiency, and safety. It offers robust lifting capabilities with a maximum load capacity of 24 metric tons.

Hangcha's American subsidiary, HC Forklift America Corporation (HCFA), has introduced the XE Series electric lithium-ion pneumatic forklifts with a capacity ranging from 4,000 lbs (1.8 T) to 7,600 lbs (3.4 T). Hangcha highlights that the integrated 80V lithium-ion forklift is suitable for challenging outdoor applications where IC pneumatic forklifts are typically used.

Toyota Material Handling, Manitowoc, Manitou Group, Takeuchi, Xtreme Manufacturing, Wacker Neuson, JLG, SAKAI, and LiuGong are niche players in the U.S. construction equipment market. These companies offer low product diversification and have a strong presence in the U.S. local market. Kobelco, DEVELON, Case CE, JCB, Bobcat, Kubota, Zoomlion, Terex, and HD Hyundai Construction Equipment are emerging in the U.S. construction equipment market. These companies are introducing new technologically advanced products to challenge the market share of the country's leaders.

MARKET TRENDS & DRIVERS

Investment in Green Hydrogen to Promote the Nation's Target to Achieve Net Zero Emissions

The White House has disclosed plans to allocate USD 7 billion in government funding to seven regional clean hydrogen hubs across the United States. This initiative, outlined in the 2021 Bipartisan Infrastructure Law, aims to boost the production and adoption of low-carbon hydrogen.

Four of the seven designated hubs will focus on producing blue hydrogen (derived from natural gas with carbon capture and storage), five will prioritize green hydrogen production, and two will be dedicated to generating pink hydrogen using nuclear power.

Landscaping & Gardening Trigger the Use of Compact Track Loaders in the U.S. Construction Equipment Market

The United States has the world's most significant landscape industry, with Florida, California, and New York leading landscaping businesses. The country boasts over 600,000 landscaping businesses, a significant majority of the total in North America. Fueled by a growing population, the expanding commercial and residential construction sectors are expected to drive increased demand for landscaping services in the U.S. in the forecast period and further support the growth of the U.S. construction equipment market.

New Emission Standards Drives Demand for Electric Equipment and Innovative Fuel Systems

The U.S. government planned to achieve the goal of carbon neutrality by 2050. Therefore, demand for electric equipment is expected to grow in the U.S. construction equipment market. There are several smart cities and public infrastructure projects in the pipeline. The demand for compact equipment is expected to grow due to its low carbon emission quality & having an electric version.

Increased Investment Under the Bipartisan Infrastructure Law (BIL) to Propel the Sales of Earthmoving Construction Equipment

In Jan 2024, the Biden-Harris Administration disclosed nearly USD 150 million allocated to 24 grant recipients across 20 states. The funds aim to enhance the reliability of current electric vehicle (EV) charging infrastructure by repairing or replacing approximately 4,500 existing EV charging ports and ensuring compliance with codes where necessary.

On Jan 25th, 2024, the government announced approximately USD 5 billion in federal investments to launch 37 major transportation projects nationwide. The government investment includes over USD 1 billion to replace the Blatnik Bridge, a 63-year-old structure above the St. Louis River.

High Investments Toward Decarbonizing the Country Are Supporting the Renewable Energy Sector

Small-scale solar generation also grew by 20% in 2023. The share of U.S. electricity generation from renewable energy remained steady at 22%. The U.S. Energy Information Administration anticipates utility-scale solar installations to double by 2024, reaching a record-breaking 24 GW, with wind capacity increasing by 8 GW.

The Booming Manufacturing Industry in the Country Propelled the Demand for Material-Handling Equipment in the U.S. Construction Equipment Market

In 2023, the U.S. manufacturing sector gained momentum created by three significant legislations passed in 2021 and 2022: the Infrastructure Investment and Jobs Act (IA), the Creating Helpful Incentives to Produce Semiconductors (CHIPS) and Science Act, and the Inflation Reduction Act (IRA). As of July 2023, the yearly expenditure on manufacturing construction was at USD 201 billion, recording a substantial 70% year-over-year rise and laying the foundation for continued industry expansion in 2024.

INDUSTRY RESTRAINTS

Persistent Fall in Housing Starts Across the Country May Disrupt the Residential Sector

In December 2023, U.S. single-family homebuilding experienced a significant decline of 8.6%, following a series of robust increases. However, the ongoing shortage of previously owned houses for sale continues to support new construction. As the Commerce Department's Census Bureau highlighted, single-family housing started the primary homebuilding component and reached an adjusted annual rate of 1.03 million units. Single-family homebuilding declined in the Northeast, Midwest, and the densely populated South but increased in the West.

Skilled Labour Tightness in the Market to Restrict the Growth of the U.S. Construction Equipment Market

In 2023, the non-union construction industry, as the Associated Builders and Contractors indicated, will require approximately 546,000 additional workers beyond the usual hiring pace to fulfill the labor demand.

The COVID-19 pandemic led to a significant disturbance in the U.S. labor force, commonly known as 'The Great Resignation.' In 2022, over 50 million workers resigned, following the 47.8 million resignations in 2021. However, by August 2023, the trend began to ease, with 30.5 million workers resigning.

Continuous Increase in Prices of Construction Equipment and Building Materials to Restrict the Sales of New Equipment

Additionally, fluctuations in material prices, especially for essential items like lumber, steel, and cement, could persist in 2024, further driving up project expenses and posing difficulties in sourcing necessary materials. Also, the cost of building materials in U.S. residential construction, excluding energy, rose by 0.2% in November 2023. This followed a revised 0.4% decline in October, as reported by the latest Producer Price Index (PPI) in 2023.

KEY QUESTIONS ANSWERED

- How big is the U.S. construction equipment market?

- What is the growth rate of the U.S. construction equipment market?

- Who are the key players in the U.S. construction equipment market?

- What are the trends in the U.S. construction equipment industry?

- Which are the major distributor companies in the U.S. construction equipment market?

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 234 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value (USD) in 2023 | $44.7 Billion |

| Forecasted Market Value (USD) by 2029 | $57.1 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | United States |

VENDOR LANDSCAPE

Key Vendors

- Caterpillar

- Hitachi Construction Machinery

- Komatsu

- Liebherr

- Volvo Construction Equipment

- John Deere

- SANY

- Xuzhou Construction Machinery Group (XCMG)

- Kobelco

- Hyundai Construction Equipment

- Develon

- Bobcat

- JCB

- Terex Corporation

- Zoomlion Heavy Industry Science & Technology Co., Ltd.

- CASE Construction Equipment

Other Prominent Vendors

- Kubota

- Toyota Material Handling

- Manitou

- Takeuchi Manufacturing Co., Ltd.

- Liugong

- JLG

- The Manitowoc Company, Inc.

- Wacker Neuson

- Yanmar

- Tadano

- KATO WORKS CO., LTD.

- Hydrema

- Haulotte

- Mecalac

- MERLO Group

- Kioti Tractor

- AUSA

- Sunward

- Ammann

- Link-Belt Cranes

- SAKAI

- Shandong Lingong Construction Machinery (SDLG)

- GEHL

- Xtreme Manufacturing

- Hy-Brid Lifts

Distributor Profiles

- National Equipment Dealers

- Equipment USA

- Kirby-Smith Machinery INC

- Mico Equipment

- My Equipment

- Mcclung-Logan Equipment Company, Inc.

- Cowin Equipment Company

- Williams Machinery

- Scott Equipment Company, LLC

- Doggett Equipment Services Group

- Sonsray Machinery

- Cisco Equipment

SEGMENTATION ANALYSIS

- Earthmoving Equipment

- Excavator

- Backhoe Loaders

- Wheeled Loaders

- Other Earthmoving Equipment (Other loaders, Bulldozers, Trenchers)

- Road Construction Equipment

- Road Rollers

- Asphalt Pavers

- Material Handling Equipment

- Crane

- Forklift & Telescopic Handlers

- Aerial Platforms (Articulated Boom Lifts, Telescopic Boom lifts, Scissor lifts)

- Other Construction Equipment

- Dumper

- Tipper

- Concrete Mixer

- Concrete Pump Truck

- End Users

- Construction

- Mining

- Manufacturing

- Others (Power Generation, Utilities Municipal Corporations, Oil & Gas, Cargo Handling, Power Generation Plants, Waste Management)

For more information about this report visit https://www.researchandmarkets.com/r/rsidfh

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment