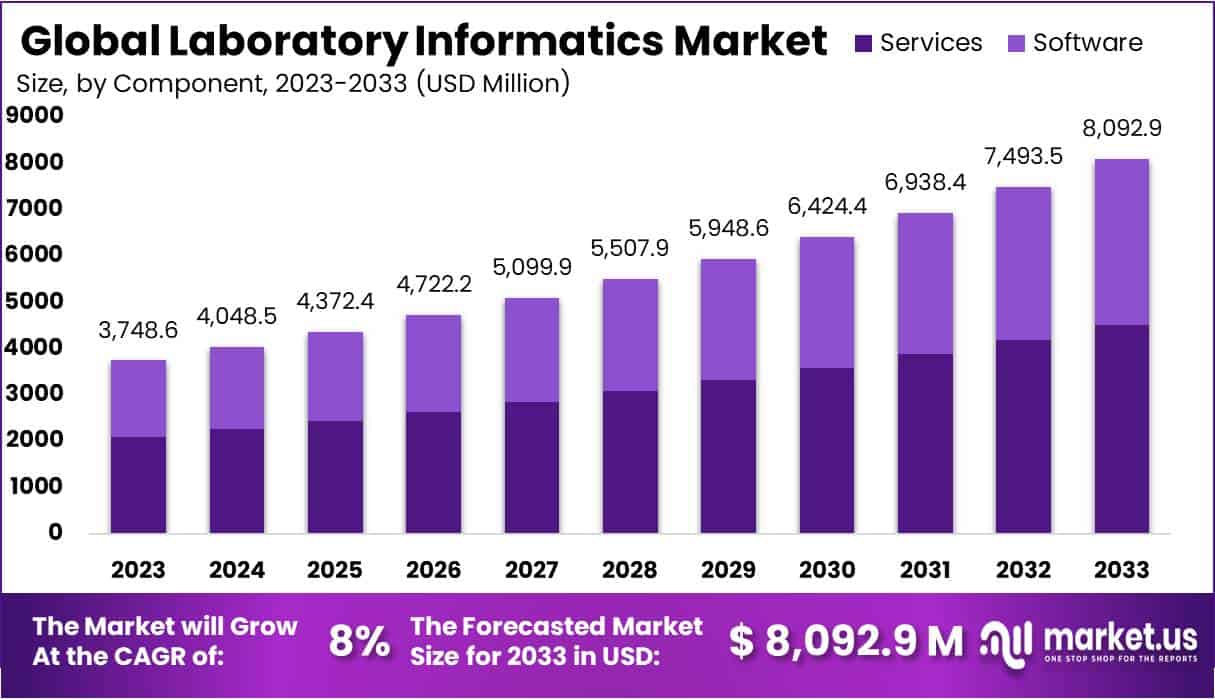

New York, Feb. 21, 2024 (GLOBE NEWSWIRE) -- According to Market.us, the Global Laboratory Informatics Market size is forecasted to exceed USD 8,092.9 Million by 2033, with a promising CAGR of 8.0% from 2024 to 2033.

The process of applying information technology and data management systems in the laboratory environment is popularly known as laboratory informatics. To streamline and enhance the process and operations within a laboratory setting there is an extensive need of computer systems, software applications and other related technologies. Increasing patient engagement and preference for personalized medicines increases the demand for laboratory automation systems.

Access a sample PDF report @ https://market.us/report/laboratory-informatics-market/request-sample/

Key Takeaway

- The technological advances in molecular genomes, genetic testing practices and data generation by laboratories led to a huge demand for laboratory informatics.

- By Solution analysis, the laboratory information management system dominated the market by 48.6%.

- By component analysis, service segment held a remarkable market share of 55.9% in 2023.

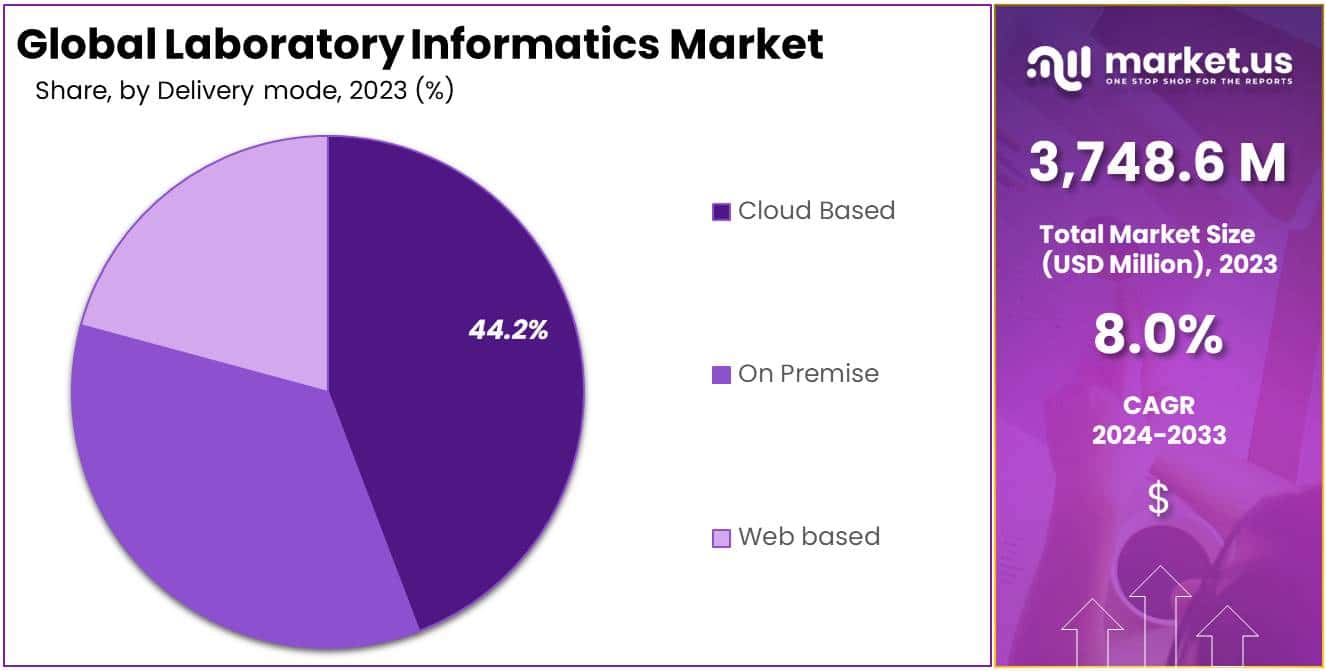

- Based on delivery mode, cloud based technology segment held a commanding position in the laboratory informatics market.

- By end User analysis, life science companies became prominent with a 29.6% of market share.

- High maintenance and service cost of laboratory informatics solutions are anticipated to restrict the market in upcoming days.

Factors affecting the growth of the Laboratory Informatics Market

- Increasing government initiatives: Increasing investments by government authorities aid in the market growth for laboratory informatics.

- Soaring prevalence of genetic disorders: The rise in genetic disorders require more systematic and rapid analysis and storage of information in laboratories. Hence, laboratory informatics provide a helping hand in managing data related to these diseases.

- Complexity of the system: Many technical errors comes across while working with information system, hence cam impede the market growth.

- Technological advancement: Advancements in technology have considerable influence on the market. With the introduction of novel technologies, the analysis and storage of data becomes easy and secure.

Top Trends in the Global Laboratory Informatics Market

The advances in the field of laboratory information management systems has led to a greater extent of market expansion. For instance, Labvantage 8.4, a latest version of laboratory management software is released by LabVantage Solutions. This updated version provides various features including improved lab efficiency, effectiveness and ease of operation. In addition to this, many major market players are more focused on the new product launches and solutions. For example, the launch of Lanexo Lab Safety, Compliance and Inventory management system by Milipore Sigma reduced lab time, increasing data quality and traceability.

Market Growth

The laboratory information system provide flexibility in terms of user interface like Abbott Healthcare LIMS platform STARLIMS is such a tool that can be operated through mobile applications, thus making diagnostic tests easier. The major companies are more focused on new approaches for managing laboratory information, fulfilling the changing requirements of healthcare system. To avoid diagnostic errors and provide better services, laboratories and clinics are implementing various tools such as Laboratory Information Systems (LIS) and Laboratory Information Management System (LIMS).

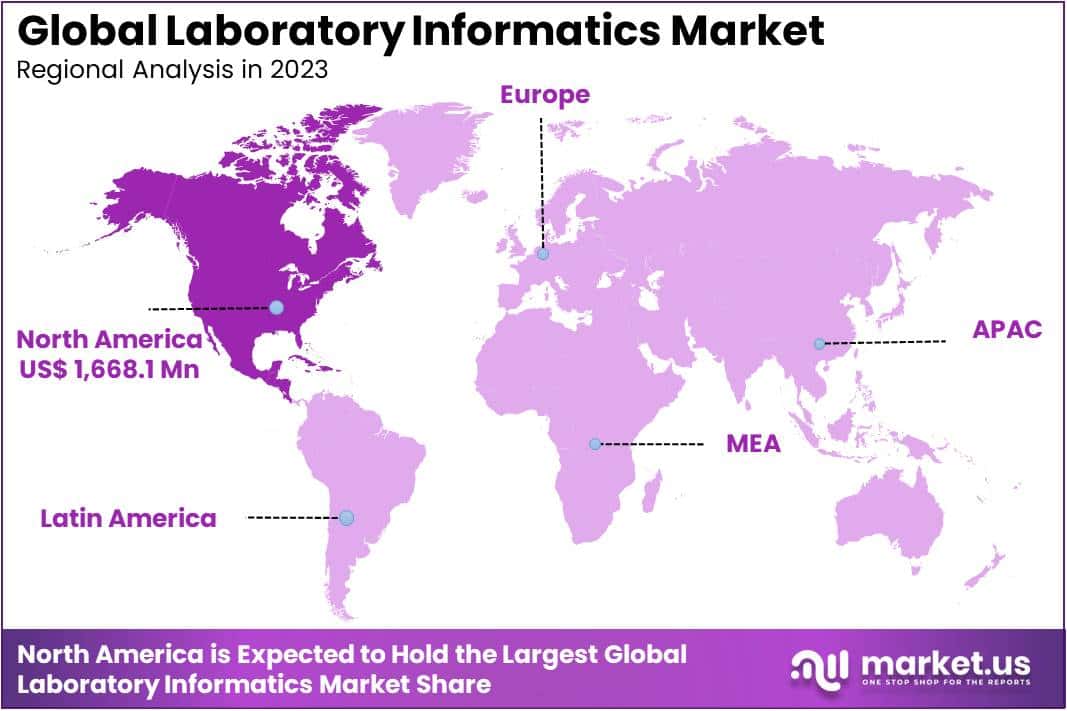

Regional Analysis

North America came up as a frontrunner in 2023, capturing a large market portion of 44.5%, dominating the other regions. The dominance of the region owes to the fact of the region being leveraged with policies supporting deployment of laboratory management systems and presence of well-developed infrastructure having high digital literacy. Additionally, the regions’ well-established pharmaceutical companies and the need to limit operational cost associated with the information system operations further elevates the market growth.

Moreover, owing to the growing number of CROs offering LIMS solutions, Asia-Pacific region is projected to show a dense growth during the forecast period. There is an increasing demand for e-Clinical services due to the rise of infectious and cardiovascular diseases in India, thus leading to an extending demand for laboratory informatics services in the near future.

Gain a deeper understanding of how our report can elevate your business strategy. Inquire about a brochure at https://market.us/report/laboratory-informatics-market/#inquiry

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 3,784.6 million |

| Forecast Revenue 2033 | USD 8,092.9 million |

| CAGR (2024 to 2033) | 8% |

| North America Revenue Share | 44.5% |

| Base Year | 2023 |

| Historic Period | 2018 to 2022 |

| Forecast Year | 2024 to 2033 |

Market Drivers

There is reduction of manual intervention in laboratory processes with the improvements in lab productivity. This productivity is directly associated with implementation of dedicated workstations, software to program instruments and installation of software to automate routine lab procedures. This provides the individual researcher to focus more on important task, providing high quality data and satisfactory documentation. Additionally, the laboratory analytics solutions help in efficient data storage, analysis and sharing of information, thus improving, accelerating and increasing the efficiency and productivity of laboratory processes. Hence, these advancing laboratory techniques drive the growth of laboratory analytics market in a fruitful way.

Market Restraints

The small and medium sized laboratories encounter several problems while dealing with laboratory analytics solutions. This is because, laboratory information solutions require high maintenance and hefty service fees. According to some industry experts, the maintenance of these information solutions are higher than their actual cost. In fact, training and implementation cost are also 15% of the total price. Thus, these factors create various hurdles, limiting the adoption of laboratory information solutions by many small and medium sized laboratories.

Opportunities

The lack of proper standardization and regulations related to LIMS in the emerging countries like China, India, Brazil, Singapore and Middle East opens up huge opportunities for vendors who cannot meet these standards. In order to lower the cost many biopharmaceutical companies are moving their manufacturing plants to Asia, upscaling a demand for information technology solution in Asian Countries. Thus, this provides lucrative opportunities elevating the revenue shares in the upcoming years.

Secure Your Copy Instantly | Obtain This High-Quality Research Report https://market.us/purchase-report/?report_id=104539

Impact of Macroeconomic Factors

There was a huge change in healthcare sector with the outbreak of COVID 19. Almost half of the laboratories were shut down and only 15% were functional. The strict regulations by government, social distancing norms, movement restrictions and supply chain disruptions created logistical problems for companies. But on the other hand, with the emergence of COVID 19, clinical labs have scaled up their operations and faced new challenges comprising development, standardization and validation of new methods for testing, administration of huge volumes of patient specimens and test data. Thus, to speed up high demand COVID 19 tests in clinical labs, LIMS plays an essential role which led to the adoption of the product.

Report Segmentation of the Global Laboratory Informatics Market

By Solution analysis

Based on solution analysis, the market is fragmented into laboratory information management systems, electronic lab notebooks, chromatography data systems, laboratory execution systems, enterprise content management and scientific data management systems. Dominating the market share by 48.6%, laboratory information management system held a commanding position in 2023. The system allows master data management and reporting of sample lifecycle, system administration, schedules and inventory. Furthermore, the system also has storage capacity, logistics and logistical workflow. In addition to this, the segment continues to flourish with the rising demand for integrated services in life sciences and research for reduction of data management errors, thus enhancing quality analysis of research information.

Moreover, Electronic Lab Notebooks segment promises to register a significant growth, due to its increased adoption by researchers in analytical chemistry laboratories. The systems also provide integrated and comprehensive solutions for upscaling industry healthcare obstacles.

By Component analysis

With respect to components, the market is disjointed into services and software. The service segment held a commanding market place, capturing a large market share of 55.9% in 2023. The segment being prominent is due to an increase in outsourcing LIMS solutions. The primary reason for the services being outsourced is because of the lack of skills and resources in large pharmaceutical research laboratories to deploy analytics. There are number of benefits associated with these packages which includes compliance with promotional spending, social analytics, manufacturing process analysis, manufacturing process maintenance and predictive analytics for medical device failure. Hence there will be a rising demand among users getting aware regarding the benefits associated with the solutions.

By Delivery mode analysis

As far as delivery mode is considered, the market is segmented into on premise, web based and cloud based segments. Amounting a large market share of 44.2%, the cloud based segment dominated the laboratory informatics market in 2023. The segment further promises to continue its dominance during the prophecy period as the technology allows for remote storage of large amount of data to free up space on clients’ devices and according to client’s requirement it allows the data retrieval. In addition to this, the systems consist of benefits including real time data tracking and accessing data at a remote distance.

The adoption of cloud based systems is more by CROs due to their additional advantages such as lower labour cost, reduced time and space requirements needed for system implementation and a safe access to clinical data.

By End User Analysis

Based on end use, life science companies, pharmaceutical companies, biotech companies, chemical industries, food and beverage industries and agricultural industries. The life science companies are accounted to hold a valuable market share of 29.6%, dominating the entire end user segment. Various companies included in this segment includes biobanks, clinical and molecular diagnostic laboratories, contract service organizations, pharma and biotech firms and academic research institutes. There is an up surging demand for electronic and virtual laboratories to manage large amount of data and disaggregate research and discovery silos.

Explore Our Methodology to Understand our Research Process: https://market.us/report/laboratory-informatics-market/request-sample/

Recent Development of the Laboratory Informatics Market

- In October 2023, PerkinElmer expanded its portfolio of laboratory informatics tools through the acquisition of Sciara Technologies, renowned for its cloud-based solutions for data capture and management. This strategic move bolsters PerkinElmer’s capabilities in Laboratory Information Management Systems (LIMS) and Chromatography Data Systems (CDS), enabling them to offer more comprehensive data management solutions to laboratories.

- In September 2023, LabVantage partnered with BenchSci to integrate artificial intelligence (AI) into its informatics suite. This collaboration empowers researchers to leverage AI-driven data analysis directly within the Laboratory Information Management System (LIMS) environment, enhancing efficiency and facilitating potential discoveries in scientific research.

- In June 2023, Waters Corporation unveiled a significant update to its Oasis LIMS platform. This update prioritizes user experience enhancements, improved data visualization tools, and enhanced integration capabilities with laboratory instruments. Waters Corporation is committed to ensuring its LIMS offerings remain contemporary and competitive in the market.

- In May 2023, Thermo Fisher Scientific announced a strategic collaboration with Microsoft to develop and deploy cloud-based laboratory informatics solutions. Leveraging the robust capabilities of Microsoft’s Azure cloud platform, this partnership aims to deliver secure and scalable informatics solutions, meeting the growing demand for cloud-based data management in laboratory environments.

Market Segmentation

By Solution

- Laboratory Information Management Systems

- Electronic Lab Notebooks, Chromatography Data Systems

- Laboratory Execution Systems

- Enterprise Content Management

- Scientific Data Management Systems

By Component

- Software

- Service

By Delivery Mode

- On-Premise

- Web-Hosted

- Cloud-Based

By End-User

- Pharmaceutical Companies

- Biotech Companies

- Chemical Industries

- Life Sciences Industries

- Food & Beverage Industries

- Agricultural Industries

By Geography

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

Prominent key players in foreign markets employ different strategies to cement their positions in the market. Increasing research and development facilities and current activities is a priority for some laboratory informatics companies on the market. Moreover, through mergers and investments and acquisitions, businesses in the laboratory informatics market are developing strategies to expand portfolios and introduce new products.

Market Key Players:

- Thermo Fisher Scientific, Inc.

- Core Informatics

- LabWare, Inc.

- PerkinElmer, Inc.

- LabVantage Solutions, Inc.

- LabLynx, Inc.

- Agilent Technologies

- ID Business Solutions Ltd.

- McKesson Corporation

- Waters Corporation

- Abbott Informatics

Explore More Life Science Market Research Reports

- Regenerative Medicine Market size is expected to be worth around USD 194.9 Billion by 2032 from USD 34.6 Billion in 2022

- Global Radiopharmaceuticals market size is expected to be worth around US$ 10.3 Bn by 2032 from US$ 4.5 Bn in 2022 at a CAGR of 8.85%.

- Global Antibiotics Market size is expected to be worth around USD 58.4 Billion by 2032 from USD 40.9 Billion in 2022

- Monoclonal Antibodies Market size is expected to go around USD 588.0 Billion by 2032 from USD 198.2 Billion in 2022, at a CAGR of 11.80%

- Global cancer immunotherapy market size is expected to be worth around USD 674 Bn by 2032 at a CAGR of 13.8% forecast period from 2022-2032

- Smart Medical Devices Market Size Was To Reach USD 153 Billion In 2022 And Projected To Reach a Revised Size Of USD 474 Billion By 2032, At a cagr of 12.3%.

- Global DNA Sequencing Market Size Was To Reach USD 10.1 Billion In 2022 And projected to reach a revised size of USD 40.5 Billion By 2032

- Global Bronchoscopes Market is USD 2.8 Bn in 2023 it is expected to reach USD 7.0 Bn in 2032 at a CAGR of 9.9%

- Influenza Vaccine Market size is expected to be worth around USD 6.7 BN by 2023 from USD 13.9 BN in 2032, at a CAGR of 7.6% (2024-2033).

- Global Life Science Analytics Market size is expected to be worth around USD 20.9 Billion by 2033 from USD 9.7 Billion in 2023

About Us:

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us on LinkedIn

Our Blog: